01. INTRODUCTION – Healthcare Investment Opportunity In GCC

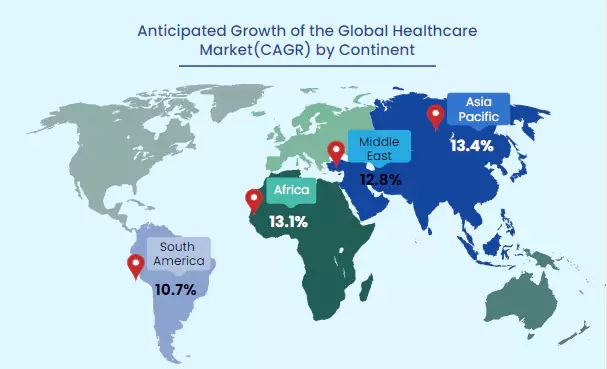

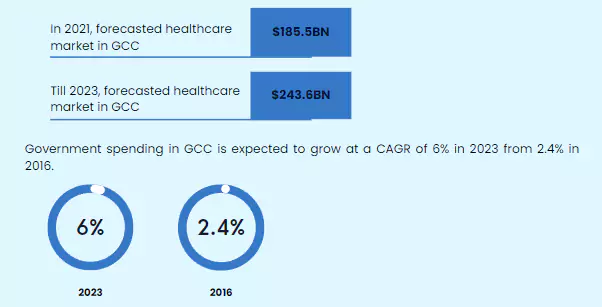

The healthcare market in the Gulf Region which includes UAE, KSA, Qatar, Oman, Jordan, Kuwait, and Bahrain are showing tremendous growth and major international healthcare organization is looking for opportunities to establish in these markets.

Post the pandemic, the healthcare sector has seen tremendous growth, especially in the digital health industry. In the Gulf region, Saudi Arabia has emerged as a strong potential market which constitutes a population of 35 million.

02.UAE (United Arab Emirates)

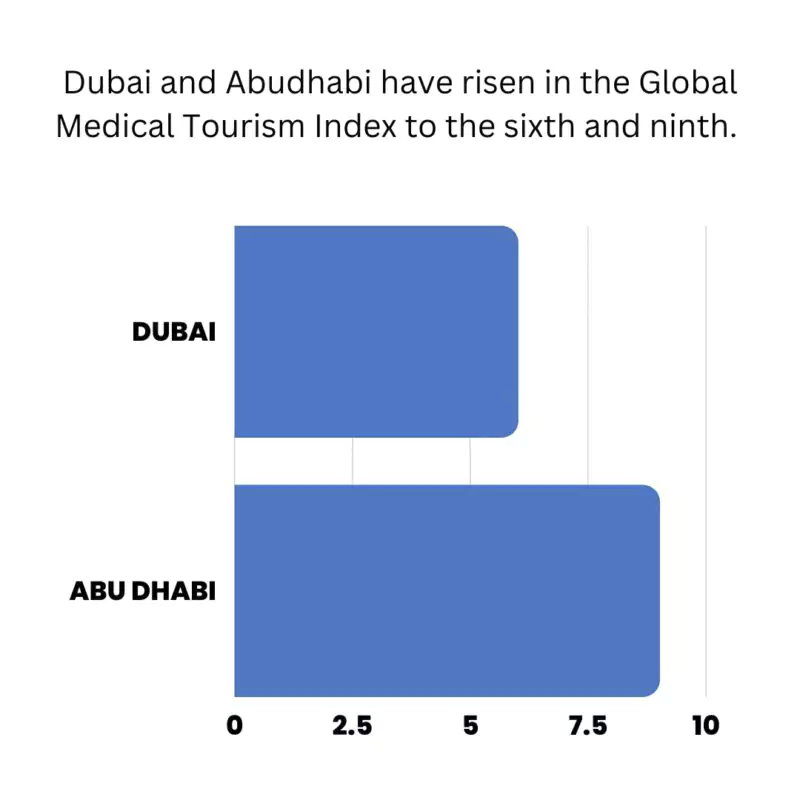

The Healthcare market in Dubai is expected to grow at a CAGR of 10% from 2019-2023, with healthcare projects worth $60.9 Billion under development in UAE.

Specialties such as orthopedics, aesthetics, dentistry, and IVF have been increasing in demand among medical tourists.

As of now, many international players have already established their footprint in the market such as Cleveland Clinic, Kings College Hospital, Mediclinic, education programs by NYU Abu Dhabi, and John Hopkin’s Bloomberg School of Public Health.

Dubai Healthcare City (DHC) which houses 160 clinical partners.

Dubai Science Park (DSP) is the region’s first free zone serving the entire value chain of the sector.

Dubai is considered a hub of medical & healthcare innovation, developing an R&D sector for health-tech, precision medicine, and biotechnology.

The ease of setting up a business and positive investment ecosystem, attract a lot of global healthcare companies to establish in Dubai. The Dubai Health Strategy aims to promote public private partnership in developing primary care models, COEs in certain specialized services, home care and rehabilitation services.

03. KSA (Kingdom of Saudi Arabia)

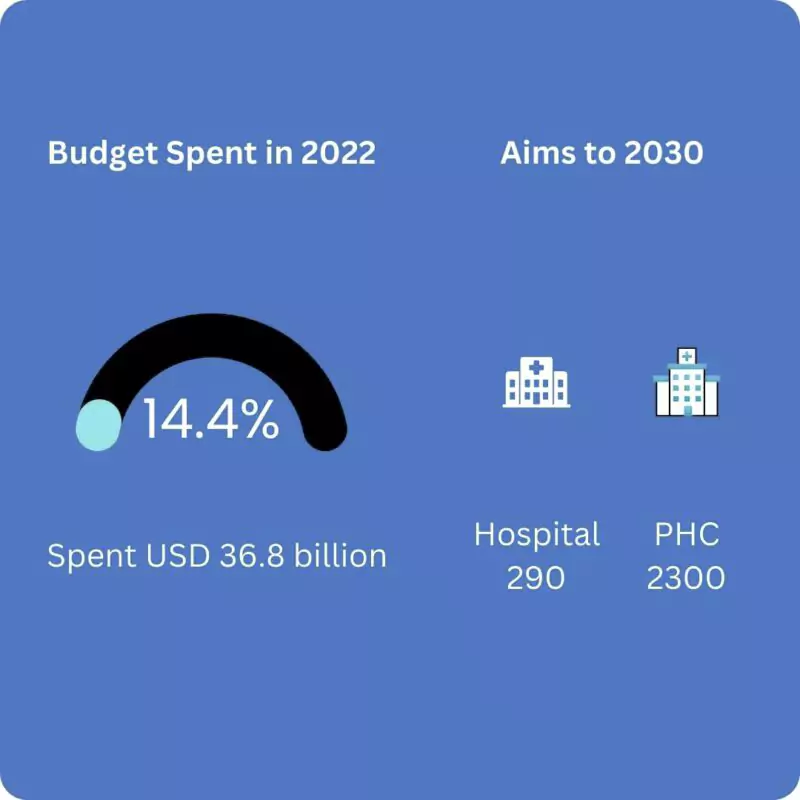

As per the budget to be spent on healthcare in 2022 was approximately USD36.8 billion, which is 14.4% of the annual budget, This indicates a positive trend for healthcare investors in the region.

The country aims to boost public-private partnerships by privatizing 290 hospitals and 2300 PHC by 2030.

Based on research KSA is expected to have a demand for 40,000 beds by 2035, due to the increasing population, increased life expectancy, and increased incidence of lifestyle-related diseases.

The Health Sector Transformation Programme, which is a part of the Saudi Vision 2030 will help in restructuring the healthcare sector into a comprehensive, effective, and integrated health system paving the way for international organizations to establish in the country.

- Managing, storing, and retrieving paper records electronically saves time and space.

- Improve workflows by keeping track of patients and managing those who visit the medical facility with the help of EMR.

- In addition to interacting with laboratories, pharmacies, hospitals, and state and national health systems, clinics can also interconnect with laboratories, pharmacies, and hospitals which helps in developing a multi-disciplinary approach.

- Analyzing patient data enables clinics to reach out to patients. Providers are able to reach discrete populations through this accessibility, resulting in improved health outcomes.

03. QATAR

The Healthcare sector in Qatar ranks among the top 5 in the world and the market is forecasted to reach an estimated net worth of $ 12 billion by 2024.

Qatar has a high per capita spending in healthcare for the MENA region , thus emphasizing that the government has prioritized the healthcare quality to be delivered for its population and helps build a healthcare ecosystem that will attract medical tourists.

that will initially focus on the promotion of the importance of healthy physical and mental well-being during the event. Post which it will work in collaboration to put forward various initiatives for the same. This will pave the way for specialized centers for wellness and rehabilitation services as well.

Qatar’s healthcare system is thriving due to the government’s constant efforts to promote and allocate investment in medical technology and R&D. Increase in Qatar’s population both the nationals as well as ex-pats indicate an increasing need for specialized facilities in the country.

04. Role of Forte Healthcare

Who We are?

For over 23 years, Forte Healthcare has developed and managed healthcare facilities that have been profitable across Dubai and GCC.

Additionally, Forte Healthcare apart from managing the operations also recommends to their clients a list of highly qualified physicians handling costs related to identification, negotiation, and recruitment.

Our Services

We provide comprehensive services from the inception of a project up to developing and building a highly productive healthcare business with state-of-the-art facilities and services and providing value-added care for our patients.

Featuring a customer-driven strategy, Forte Healthcare aims to consistently meet customer expectations and ensure sustainable growth.

The team at Forte closely evaluates the demand and supply across geographical location and suggest the appropriate positioning of the clinic brand.

Financial feasibility is expanded across all services and with a cost vs. benefit analysis to evaluate what’s relevant in each market, also The segmentation is vital for healthcare facilities given tier-based on insurances and facilities in GCC / Middle East countries.

An essential goal of vital arranging is to recognize inside qualities and deficiencies as well as outside dangers and opportunities. As a result of this contribution, you will have hierarchical ownership, which is vital to the execution and maintenance of your arrangement.

05. Summary

The Directors at Forte come from successfully starting and operating successful Aesthetic and wellness services chains in Asia, and GCC including UAE, Oman, Qatar, Kuwait, Bahrain & KSA.

Our expertise starts from the company structure, incorporation, bank accounts, commercial lease negotiations, location validation, facility layouts, regulatory compliance and approvals, design and architecture, construction management, Recruitment and onboarding, Branding, Social media marketing, PR, Launch and manage the facility ensuring business and operations objectives are met.

A business plan made by a team of Forte Healthcare is as follows:

1. Market overview and trends

- Demographics

- Regulatory compliance

- Supply gap

- Supply chain and logistics

- Insurance

- Facility updates

- Key demand drivers

2. Competitor analysis

- Direct competitors

- Indirect competitors

3. Services to be provided

4. Financial Model

- CAPEX

- Project timelines

- Revenue & EBITDA